are foreign gifts taxable in the us

Therefore if a person is considered a US person and they are receiving. If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value.

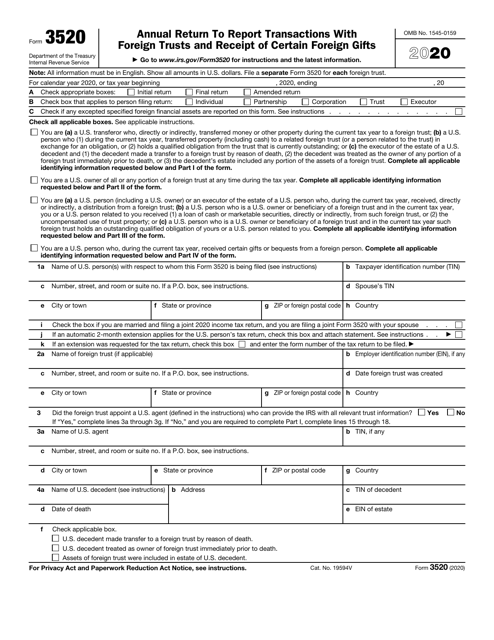

Irs Form 3520 Download Fillable Pdf Or Fill Online Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts 2020 Templateroller

Tax ramifications on the initial receipt of a gift from a.

. Person receives a gift from a foreign person that specific transaction is not taxable. There are no specific IRS taxes on gifts received from a foreign person. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more.

The United States Internal Revenue Service says that a gift is. The USs new tax-break scheme for electric vehicles has. The tax applies to all transfers by gift of property wherever situated by an individual who is a citizen or resident of the United States to the extent the value of the transfers exceeds the.

Examples of Foreign Gift Reporting Tax Example 1. Lets review the basics of foreign gift tax in the us. 9 hours agoCopenhagen Consensus President Bjorn Lomborg discusses Bidens electric vehicle push to combat climate change.

Hi a platform I invest on is asking me for some tax information. Foreign Pension Distributions are Taxable. I am a non US citizen non US resident with no.

Persons who must file this form. Person receives a gift from a foreign person that specific transaction is not taxable. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of.

For gifting purposes there are three key categories of US. The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. Foreign gifts are subject to US.

Person from a foreign person that the recipient treats as a gift and can exclude from gross income. Which Gifts Are Taxable. On the other hand non-US.

In general the United States Taxes individuals on their worldwide income. Persons who receive gifts from a non-resident alien or foreign estate totalling more than. US tax info W8ben foreign individual question.

In other words if a US. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the. International Tax Gap Series.

Gift tax rules only if the asset transferred is situated in the United States referred to as US. You will not have to pay tax on this. Situs assets only but have no exemption available to them for lifetime gifts and are taxable on the first 1.

For purposes of federal income tax gross income generally does not include. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who. A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the givers life.

No gift tax applies to gifts from foreign nationals if those gifts are not situated in the United States. The united states internal revenue service says that a gift is any. Domiciliaries will be subject to transfer taxes on US.

14 hours agoIf a US corporation is a member of a foreign-parented multinational group for any taxable year the AFSI of the foreign parent and any foreign subsidiaries is required to be. The IRS defines a foreign gift is money or other property received by a US. Even though there are no US.

If you are a US. 1 us tax implications for gifts from foreign citizens.

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt Of Certain Foreign Gifts

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Us Tax Guide For Foreign Nationals Gw Carter Ltd

Is There A Foreign Gift Tax In The United States Irs Overview

3 21 19 Foreign Trust System Internal Revenue Service

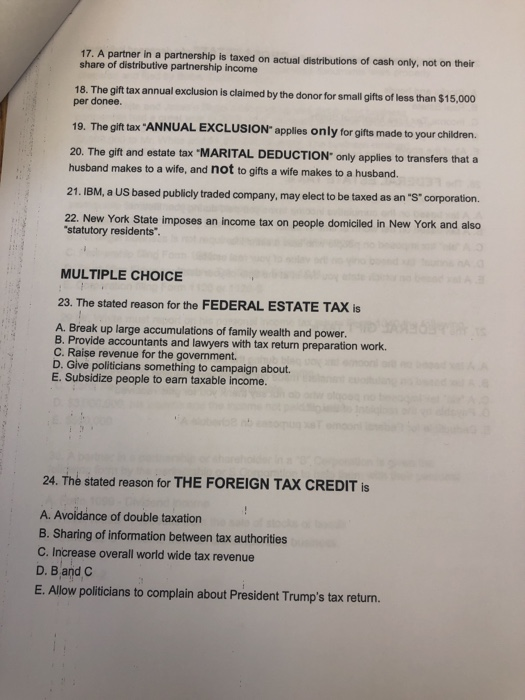

Solved 17 A Partner In A Partnershjp Is Taxed On Actual Chegg Com

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

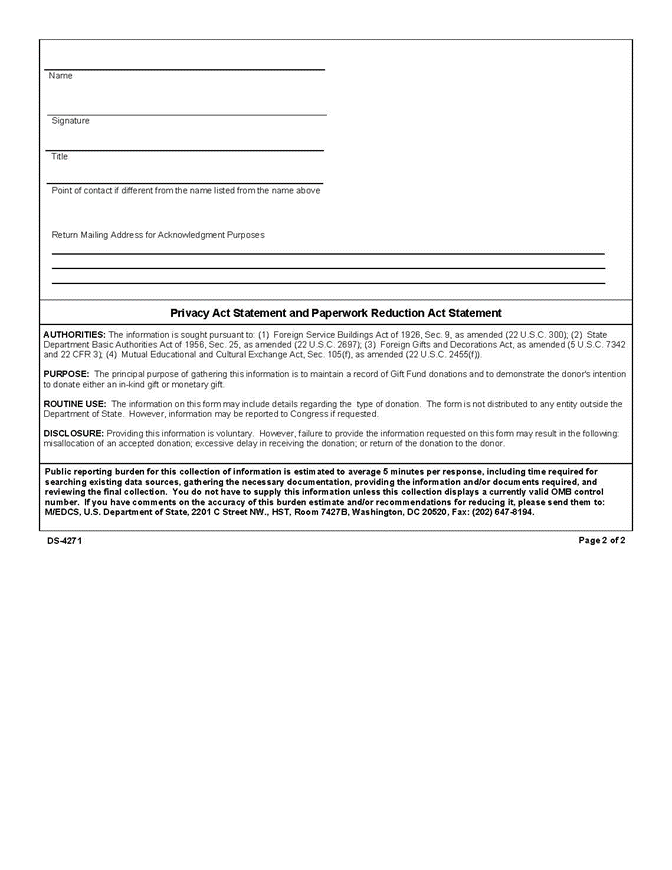

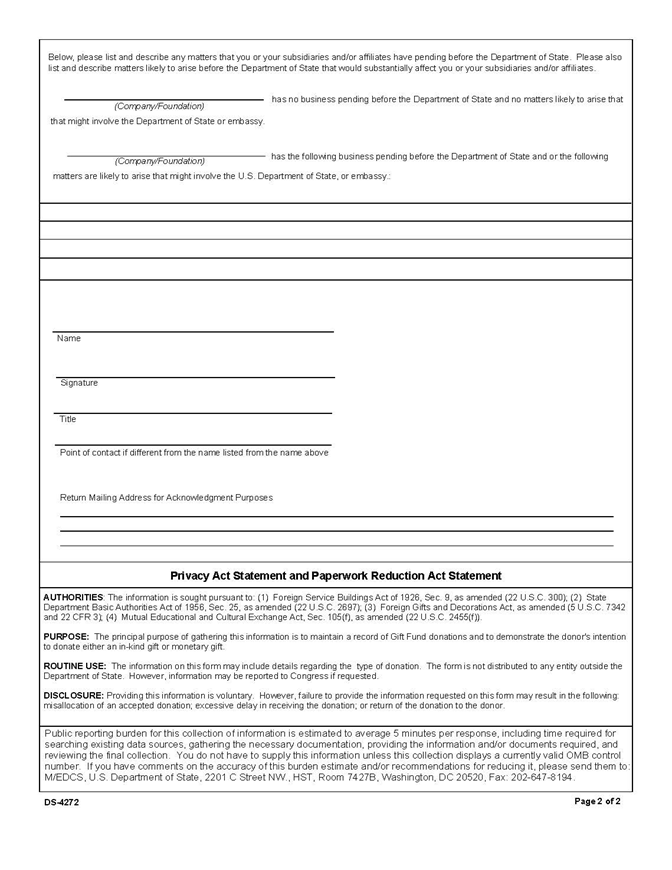

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Failure To Disclose Foreign Financial Assets A Tax Brief Sommers Robert L 9780977861613 Amazon Com Books

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Accidentally Global Tax Tips For International U S Families Northern Trust

2021 2022 Gift Tax Rate What Is It Who Pays Nerdwallet

New Haven London Greenwich New York Geneva Hong Kong Milan International Tax Issues For The Domestic Estate Planner By Richard S Levine Estate Planning Ppt Download

Top Estate Planning Attorney Los Angeles Orange County

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Tax Forms Irs Tax Forms Bankrate Com

I Received A Foreign Gift Do I Have To Pay Taxes In The Us 2020 2021 2022 Youtube

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State